According to Wikipedia; the definition of Capitalization rate (or “Cap Rate”) is a real estate valuation measure used to compare different real estate investments. Although there are many variations, a cap rate often calculated as the ratio between the net operating income produced by an asset and the original capital cost (the price paid to buy the asset) or alternatively its current market value.

Commercial real estate professionals live by capitalization rates. Every trade publication, market participant, and third-party report relating to real estate quotes cap rates for various markets and properties. But ask a group of real estate professionals to calculate a specific property’s cap rate and you are likely to get a variety of answers — despite the simplicity of the formula, why does everyone come up with a different answer?

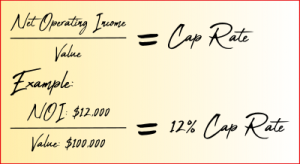

A cap rate in its simplest form is a return on an investment based on the principle of anticipation. Value is the present worth of future benefits. A cap rate attempts to quantify the risk profile of the future benefits. It is calculated by using a non-complex formula, R=I/V, where I is the net operating income and V is the value of the property. In more complex terms, a cap rate measures a single-period, unleveraged rate of return on a real estate investment. By converting income into value, a cap rate expresses the relationship of one year’s income and value.

To truly understand how to calculate the cap rate you must first know how to figure the net operating income (NOI) NOI is defined by the amount left over after fixed costs and variable costs is subtracted from gross lease income. Example; 250,000 income minus fixed costs (example = Mortgage payments) and variable expenses (example = Utilities) equals net operating income.

A cap rate’s three main components are net income, property value, and the rate of return. If two of the three variables are known, the unknown variable can be extracted through a simple calculation.

A cap rate’s three main components are net income, property value, and the rate of return. If two of the three variables are known, the unknown variable can be extracted through a simple calculation.

Granted, different types of cap rates exist — overall, terminal, equity, mortgage, building, and land — which may cause some confusion among market participants. The overall rate, or OAR, is the cap rate applied to both the land and building and is the most commonly used rate by real estate professionals. A cap rate is essentially a dividend rate, so one could call the mortgage constant a “lender” cap rate and a cash-on-cash an “equity” cap rate. However, in commercial real estate transactions, brokers and investors tend to focus on two cap rates: acquisition and disposition.

For example, if a building is purchased for $1,000,000 sale price and it produces $100,000 in positive net operating income during one year, then: 100,000 / $1,000,000 = 0.10 = 10%. Our Port Charlotte and North Port markets are seeing cap rates in the neighborhood of 5% – 7% while Miami markets are much lower cap rates which leaves only appreciation to raise the value of the property.

In real estate investment, real property is often valued according to projected capitalization rates used as investment criteria. This is done by algebraic manipulation of the formula: Capital Cost (asset price) = Net Operating Income/ Capitalization Rate

An example, in valuing the projected sale price of a shopping center that produces a net operating income of $35,000, if we set a projected capitalization rate at 7%, then the asset value (or price we would pay to own it) is $500,000. (500,000. = 35,000 / .07).

This is often referred to as direct capitalization, and is commonly used for valuing income generating property in a real estate appraisal. One advantage of capitalization rate valuation is that it is separate from a “market-comparables” approach to an appraisal (which compares 3 valuations: what other similar properties have sold for based on a comparison of physical, location and economic characteristics, actual replacement cost to re-build the structure in addition to the cost of the land and capitalization rates). Given the inefficiency of real estate markets, multiple approaches are generally preferred when valuing a real estate asset. Capitalization rates for similar properties, and particularly for “pure” income properties, are usually compared to ensure that estimated revenue is being properly valued.